Risk Management

Santen strives to establish an information management and monitoring system in response to various risks, including unpredictable uncertainties, to eliminate such risks or address them appropriately.

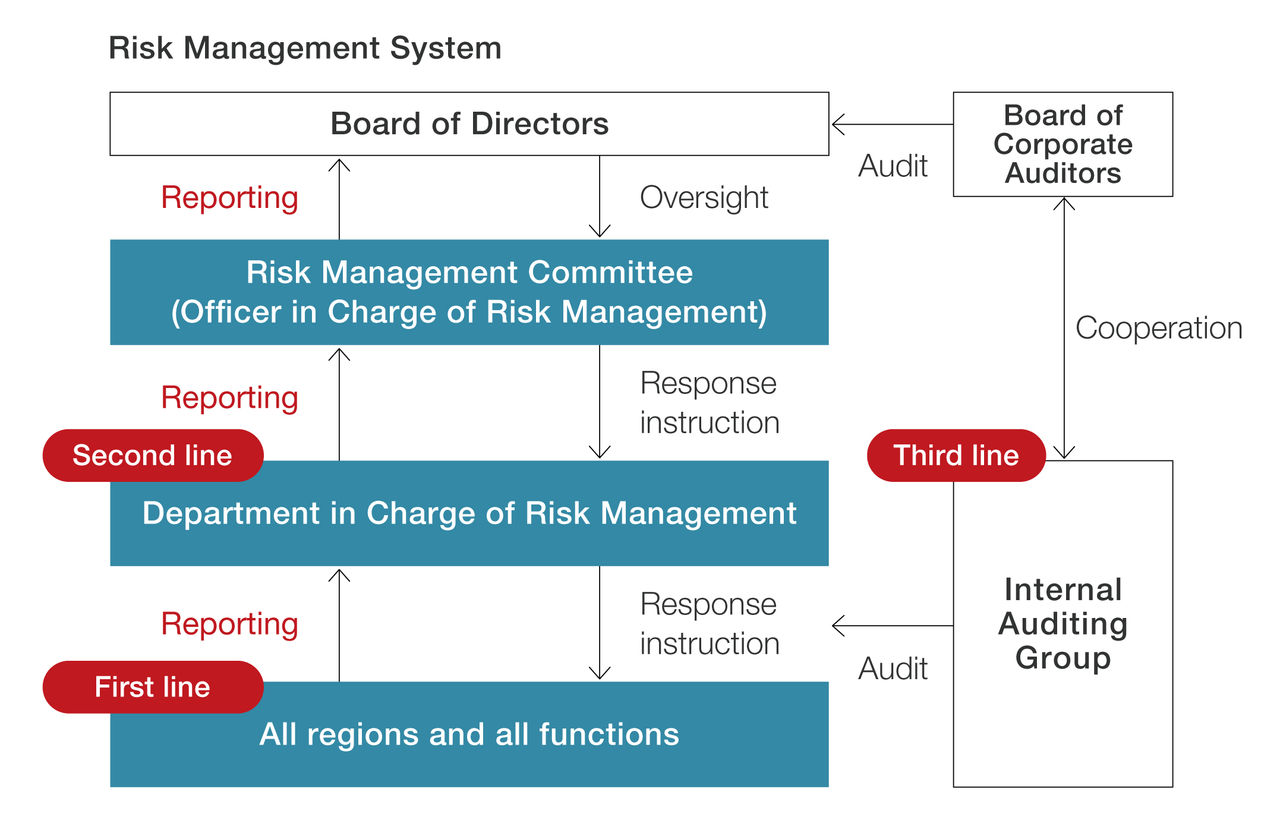

Risk Management System

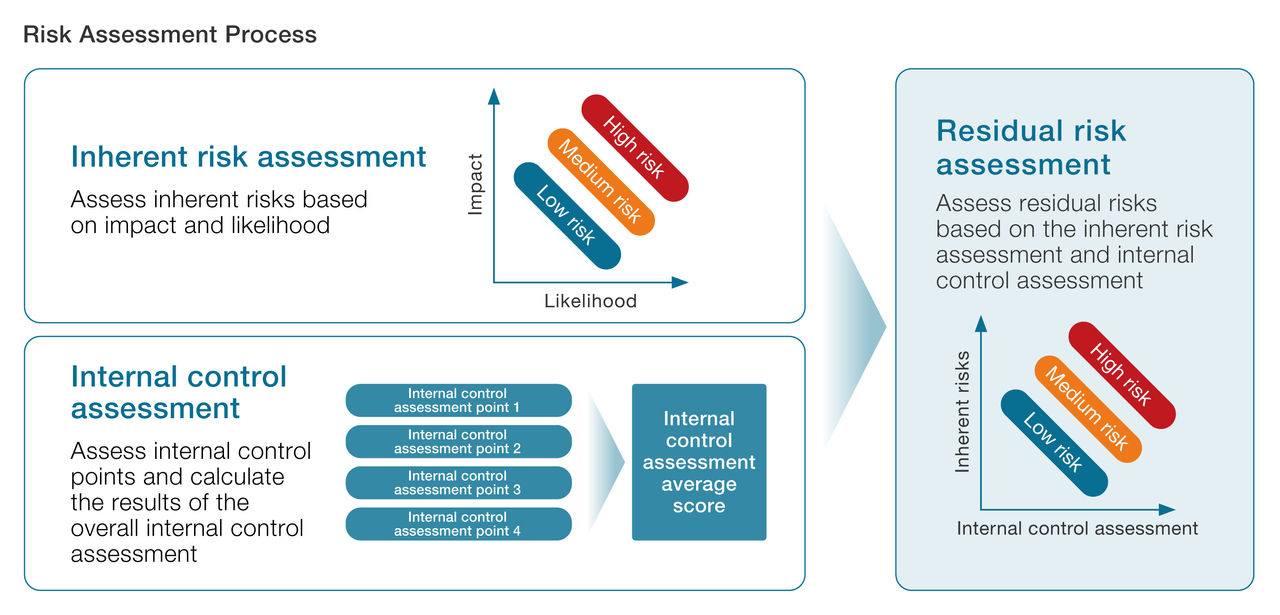

In accordance with the rules for risk management, we identify, evaluate, and monitor risks regularly in each region and division to deal with assumed major risks of loss related to the execution of our business activities, striving to avoid or minimize the risk of loss during times of normal business operations. To enhance risk management, starting from the FY2024, we will conduct interviews with each risk owner based on the Three Lines Model to confirm risk scenarios and assess ‘inherent risks.’ By evaluating ‘internal controls,’ we will calculate ‘residual risks’ annually. High residual risks will be identified as significant company-wide risks and will be deliberated by the Risk Management Committee to establish an effective enterprise-wide risk management system.

As our business expands globally, and we are required to comply with various regulations at higher levels, we must take appropriate measures to ensure the stable supply of products, quality control, IT security, and compliance, as well as to ensure management of risks such as pandemics, natural disasters, and conflicts.

To address the variety of risks that may affect our business in particular, we continue to strengthen risk management activities with preventive controls and activities that uncover potential risks under the leadership of the Officer in Charge of Crisis Management.

In its independent capacity, the Internal Auditing Group verifies the status of risk management through annual internal audits.

In the event or report of an event that has the potential to develop into a serious crisis, we form a crisis management committee, chaired by the Santen president and CEO. This committee responds to and contains the situation in question as we implement measures to prevent recurrence.

Major Risks

1) Supply chain

Risk scenario

- Suspension of operations at a specific plant (the Noto, Shiga or Suzhou Plants, in particular) or at external contractors, or the suspension of raw material supply from a supplier due to a pandemic, natural disaster, fire or other factors

- Product quality problems occur

Impacts on corporate value

- Adverse impacts of disruption or suspension, etc. of production activities on stable product supply, and on Santen’s business performance and financial condition

Countermeasures and current progress

- Create processes, systems and other mechanisms to ensure stable supply

- Having continuously a full understanding of actual conditions and respond to issues by planning, monitoring execution, and assessing risk

- Structure product manufacturing and supply for compatibility with rigorous logistics regulations in Europe

- Visualize and centralize global inventory management and production planning

2) Compliance

Risk scenario

- Violations of social norms, laws, regulations, etc.

Impacts on corporate value

- Decline in public trust and brand image

- Damage to corporate value due to a stock price decrease

- Decline in Santen’s business performance or impact on business continuity due to decreased revenue or payment of compensation for damages, etc.

Countermeasures and current progress

- Established the Code of Practice and the Global Compliance Policy; systemically enhance the structure for global compliance

- Introduced an organized global education program for all employees; implement the program

- Reinforce compliance awareness and ensure compliance with laws and regulations by designating Awareness Month for Santen’s Code of Practice, supported by messages from the CEO and regional senior management

- We created the Speak Up Portal as a global internal reporting system, and established a globally unified risk management system

3) IT Security and Information Management

Risk scenario

- Malfunction of IT systems used in business activities

- Cyberattacks, computer virus infection, etc.

- Leakage of personal or other kinds of information

Impacts on corporate value

- Adverse impacts of suspension of or delays in business activities, decline in public trust, etc. on Santen’s business performance

Countermeasures and current progress

- Operate and maintain an information security management system that meets the ISO/IEC 27001 standard

- Established the Global Information Security Policy, the Global Data Privacy Policy, the Document Management Policy, and other policies

- Enhance security governance through personnel and organizational measures centered around security training and drills and through technical measures (provide global antiphishing training as one measure to enhance cyber security)

- Ensure appropriate risk management not only within the Santen Group but also throughout its supply chain and at its business partners

4) Natural disasters

Risk scenario

- Natural disasters such as large-scale earthquakes, tsunamis, and typhoons

Impacts on corporate value

- Impact on business performance and financial condition due to stagnation or delay in production activities and supply chain disruptions

Countermeasures and current progress

- Consideration of establishing a system to ensure employee safety and a stable supply of products by developing a business continuity plan (BCP), conduct emergency response training, ensure stable inventories, formulate a backup plan for production lines, and purchase property insurance

5) Geopolitical Risk

Risk scenario

- Sudden changes in international conditions or the occurrence of conflicts between nations

Impacts on corporate value

- Impact on business activities and supply chain disruptions in related regions, resulting in product supply delays, etc.

Countermeasures and current progress

- Obtain external information, analyze impact on domestic and overseas operations, and develop a safety management system in preparation for contingencies

- Examine the establishment of a backup system to ensure product supply

6) Risk related to Investment

Risk scenario

- Due to the deterioration of external conditions beyond the level anticipated at the time of the investment decision, the initially expected effects or profits may not be fulfilled

Impacts on corporate value

- The impairment of tangible fixed assets and intangible assets recorded in connection with investments affect the performance of the Santen Group

Countermeasures and current progress

- In addition to qualitative aspects such as alignment with the management strategy, investment decisions are made based on internal evaluation criteria that use a hurdle rate exceeding the cost of capital from a profitability perspective

- A Strategy Deliberation Committee is established to discuss important strategic issues, ensuring organic coordination between medium- to long-term strategies, business and development portfolios, and individual proposals submitted to the Board of Directors. This includes clarifying the positioning of individual projects within the overall strategy and organizing key points

- A system is introduced to regularly and continuously monitor the progress of projects decided by the Board of Directors, thereby enhancing and strengthening corporate governance

7) Dependence on Key Products Risk Scenario

Risk scenario

- For top-selling products that account for a high proportion of consolidated revenue, sales may be discontinued due to factors such as product defects or unexpected side effects

Impacts on corporate value

- Significant decrease in revenue, affecting performance or financial condition

8) Dependence on Licensed Products Risk Scenario

Risk scenario

- For products licensed from other companies, issues such as the expiration of the contract period, changes in contract terms, or termination of sales partnerships

Impacts on corporate value

- Impact on performance, including revenue

Emerging Risks

We recognize emerging risks as those that have become particularly risky in recent years due to environmental changes and other factors.

1) International Disputes

Description

- International disputes that are still taking place in several countries and are expected to become more serious will not only affect the supply chain in those regions, but also impact raw materials procurement, product supply, etc.

Impact

- Such events cause concern for the safety of employees in the areas affected, as well as concerns about the impact on supply chains, finances, and sanctions

- If production activities, including the activities of our contract manufacturers, are affected, the supply of products to the entire global market could be affected negatively

Countermeasures and current progress

- Recognition of possible risks and consideration of contingency response manuals

- Monitor geopolitical, socio-political and economic/political conflicts in the countries and regions where key supplies and suppliers are located

Risk Culture

We strive to foster a risk culture throughout the organization. As part of these efforts, we provide in-house training on internal controls, compliance, and other topics via e-learning, and the training participation and other factors are included in the compensation evaluation of directors and employees. In terms of risk management, all relevant departments are involved in the evaluation of each risk. Furthermore, senior management discusses significant risks and their countermeasures in the Risk Management Committee, thereby promoting the formation of risk awareness.

When developing products and services, we analyze the relevance and risks at the development strategy and planning stages to consider risk mitigation. At the same time, we have the PTS Committee review and determine the Probability of Technical Success (PTS) of a project. In addition, we establish financial criteria to assess investment risk and determine business feasibility. We then perform development in accordance with the rules determined. Depending on the phase and monetary standards, the Board of Directors will discuss risks before making a decision on certain development and investment projects.