Accounting Standards and Definition of “Core Base”

(Reference) Accounting Standards and Definition of "Core Base"

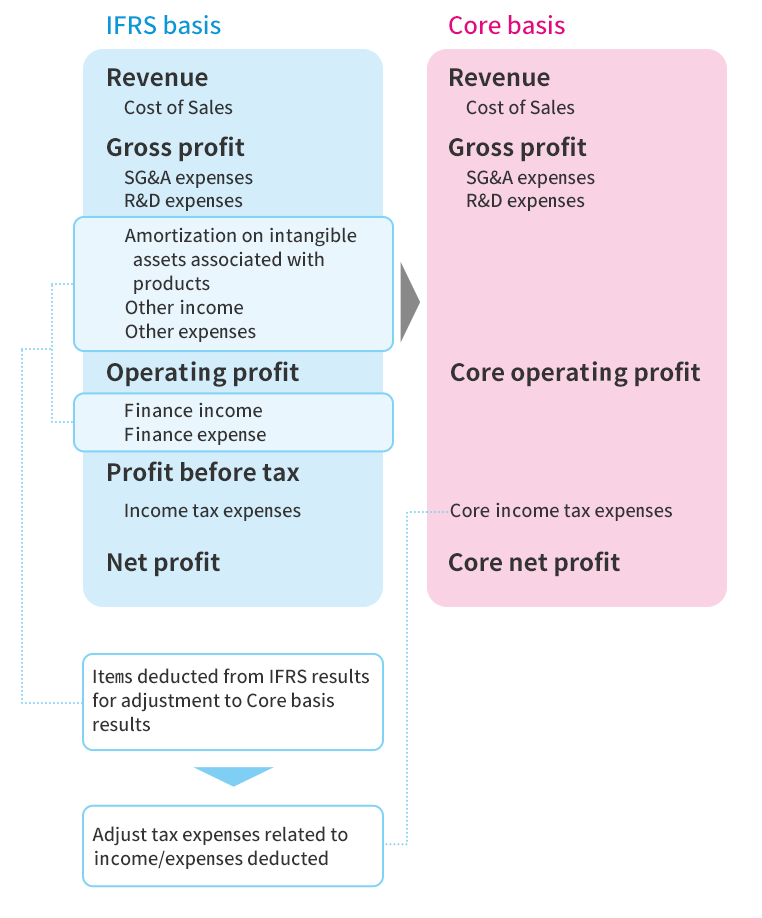

With the adoption of IFRS, the Santen Group discloses financial information on a core basis, which is calculated by excluding certain income and expenses item from the IFRS basis, as an indicator of profitability from business activities.