Distribution of Profits to Shareholders and Dividends

Recognizing profit distribution to shareholders as one of its vital management goals, Santen will continue executing appropriate, performance-based dividend payments, while making sure to increase its capital efficiency, invest in R&D projects that will help enhance its corporate value, and retain earnings for the development of its future growth strategies. Santen will also consider repurchasing or retiring its own stocks in a timely manner.

In its Articles of Incorporation, Santen states its decision to pay interim dividends.

Dividend payout levels will be determined by the Board of Directors for the interim dividend and by the General Meetings of Shareholders for the year-end dividend.

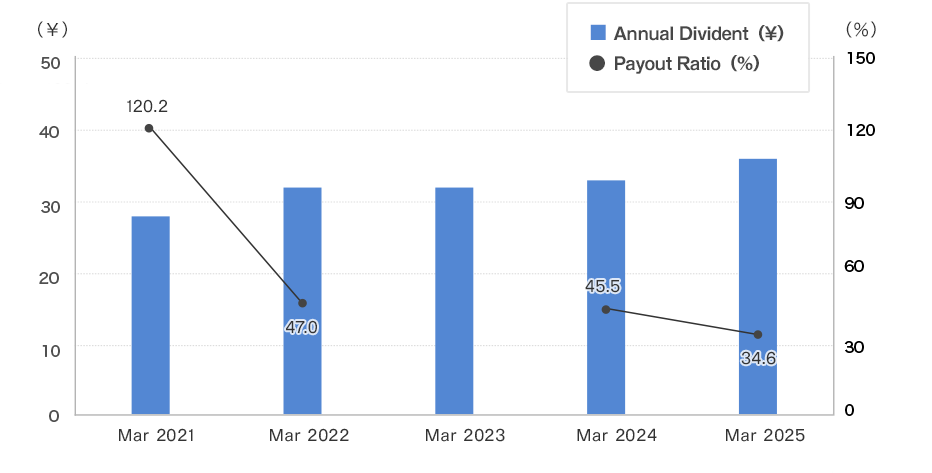

Dividend per share

| Account Closing Month | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | Mar 2025 |

|---|---|---|---|---|---|

| Interim Dividend | ¥ 14 | ¥ 16 | ¥ 16 | ¥ 16 | ¥ 17 |

| Year-end Dividend | ¥ 14 | ¥ 16 | ¥ 16 | ¥ 17 | ¥ 19 * |

| Annual Dividend | ¥ 28 | ¥ 32 | ¥ 32 | ¥ 33 | ¥ 36 * |

| Payout Ratio | 120.2% | 47.0% | - | 45.5% | 34.6% * |

Shareholder Returns and Dividends

Repurchase of treasury stocks

| Time | Number of stocks (Thousands of stocks) | Total amount of repurchased stocks (Millions of yen) |

|---|---|---|

| May 2022 | 3,291 | 3,367 |

| Jun 2022 | 3,814 | 3,830 |

| Jul 2022 | 547 | 596 |

| Aug 2022 | 3,540 | 3,646 |

| Sep 2022 | 1,307 | 1,293 |

| Nov 2022 | 2,152 | 2,344 |

| Dec 2022 | 2,276 | 2,556 |

| Jan 2023 | 3,607 | 3,688 |

| Feb 2023 | 3,088 | 3,079 |

| Mar 2023 | 1,248 | 1,333 |

| May 2023 | 2,310 | 2,884 |

| Jun 2023 | 3,360 | 4,153 |

| Jul 2023 | 756 | 926 |

| Aug 2023 | 1,860 | 2,440 |

| Sep 2023 | 523 | 723 |

| Oct 2023 | 1,511 | 1,990 |

| Nov 2023 | 1,347 | 1,824 |

| Dec 2023 | 904 | 1,240 |

| May 2024 | 4,051 | 6,442 |

| Jun 2024 | 3,067 | 4,919 |

| Jul 2024 | 2,855 | 4,982 |

| Aug 2024 | 2,857 | 4,908 |

| Sep 2024 | 1,348 | 2,389 |

| Oct 2024 | 2,209 | 3,938 |

| Nov 1-6, 2024 | 598 | 1,067 |

| Nov 8-30, 2024 | 3,729 | 6,298 |

| Dec 1-12, 2024 | 1,270 | 2,192 |

Retirement of treasury stocks

| Time | Number of stocks (Thousands of stocks) | Percentage to the total number of outstanding stocks (%) |

|---|---|---|

| Oct 2022 | 12,500 | 3.1 |

| Mar 2023 | 12,370 | 3.2 |

| Mar 2024 | 12,000 | 3.2 |

| Nov 2024 | 16,985 | 4.7 |

| Feb 2025 | 5,000 | 1.4 |

Special Benefit Plan for Shareholders

Santen offers no shareholder special benefit plan.

Our basic policy adheres to profit distribution to shareholders through dividend payment.