Distribution of Profits to Shareholders and Dividends

Recognizing profit distribution to shareholders as one of its vital management goals, Santen will continue executing appropriate, performance-based dividend payments, while making sure to increase its capital efficiency, invest in R&D projects that will help enhance its corporate value, and retain earnings for the development of its future growth strategies. Santen will also consider repurchasing or retiring its own stocks in a timely manner.

In its Articles of Incorporation, Santen states its decision to pay interim dividends.

Dividend payout levels will be determined by the Board of Directors for the interim dividend and by the General Meetings of Shareholders for the year-end dividend.

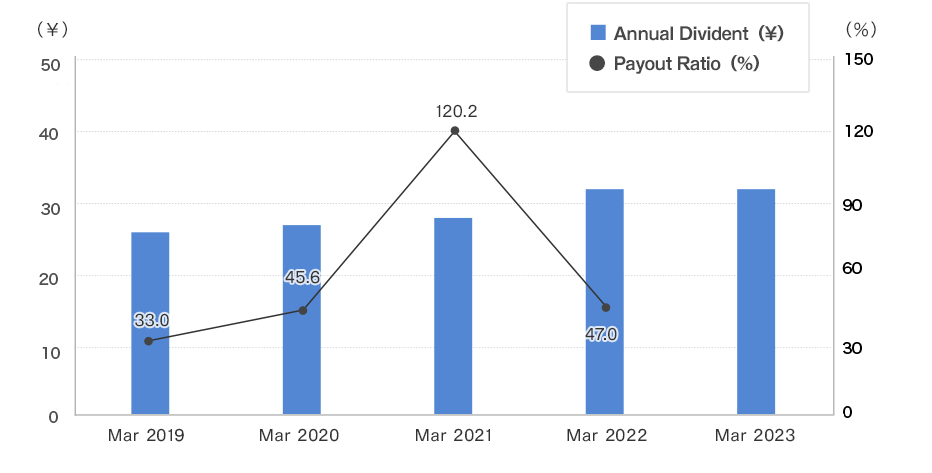

Dividend per share

| Account Closing Month | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 |

|---|---|---|---|---|---|

| Interim Dividend | ¥ 13 | ¥ 13 | ¥ 14 | ¥ 16 | ¥ 16 |

| Year-end Dividend | ¥ 13 | ¥ 14 | ¥ 14 | ¥ 16 | ¥ 16 * |

| Annual Divident | ¥ 26 | ¥ 27 | ¥ 28 | ¥ 32 | ¥ 32 * |

| Payout Ratio | 33.0 % | 45.6% | 120.2% | 47.0% | - |

Shareholder Returns and Dividends

Repurchase of treasury stocks

| Time | Number of stocks (Thousands of stocks) | Total amount of repurchased stocks (Millions of yen) |

|---|---|---|

| Mar 2001 | 2,387 | 5,084 |

| Mar 2002 | 2,000 | 3,202 |

| Mar 2003 | 2,741 | 3,237 |

| Nov 2004 | 1,351 | 2,569 |

| Mar 2008 | 1,833 | 4,800 |

| Aug 2012 | 4,937 | 13,735 |

| Nov 2016 | 8,284 | 12,310 |

| Mar 2019 | 3,838 | 6,636 |

| May 2022 | 3,291 | 3,367 |

| Jun 2022 | 3,814 | 3,830 |

| Jul 2022 | 547 | 596 |

| Aug 2022 | 3,540 | 3,646 |

| Sep 2022 | 1,307 | 1,293 |

| Nov 2022 | 2,152 | 2,344 |

| Dec 2022 | 2,276 | 2,556 |

| Jan 2023 | 3,607 | 3,688 |

| Feb 2023 | 3,088 | 3,079 |

| Mar 2023 | 1,248 | 1,333 |

Retirement of treasury stocks

| Time | Number of stocks (Thousands of stocks) | Percentage to the total number of outstanding stocks (%) |

|---|---|---|

| Mar 2001 | 2,387 | 2.5 |

| Mar 2002 | 2,000 | 2.1 |

| Mar 2004 | 2,741 | 3.0 |

| Mar 2005 | 1,351 | 1.5 |

| Nov 2012 | 4,938 | 5.6 |

| Dec 2016 | 8,300 | 2.0 |

| Mar 2019 | 7,500 | 1.84 |

| Oct 2022 | 12,500 | 3.1 |

| Mar 2023 | 12,370 | 3.2 |

Special Benefit Plan for Shareholders

Santen offers no shareholder special benefit plan.

Our basic policy adheres to profit distribution to shareholders through dividend payment.